Page 9 - Means Wealth 2020/2021 Perspectives

P. 9

Most people assume that the higher their income, the higher their marginal

rate. If you have a tax year when you have a significant capital gain event you

might assume that you will be in a higher marginal tax bracket, but that is not

necessarily the case. For example, if you are a married taxpayer filing a joint

tax return and have a $1 million long-term capital gain, ordinary income of

$500 thousand and itemized deductions of $100 thousand, you might think

that you would be in the top tax bracket of 37%. However, itemized deductions

will reduce ordinary income first, resulting in a marginal tax bracket of 32% in

this example.

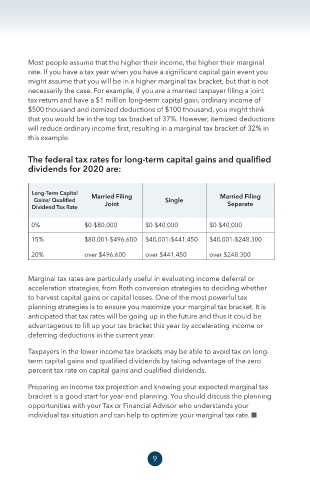

The federal tax rates for long-term capital gains and qualified

dividends for 2020 are:

Long-Term Capital

Gains/ Qualified Married Filing Single Married Filing

Dividend Tax Rate Joint Separate

0% $0-$80,000 $0-$40,000 $0-$40,000

15% $80,001-$496,600 $40,001-$441,450 $40,001-$248,300

20% over $496,600 over $441,450 over $248,300

Marginal tax rates are particularly useful in evaluating income deferral or

acceleration strategies, from Roth conversion strategies to deciding whether

to harvest capital gains or capital losses. One of the most powerful tax

planning strategies is to ensure you maximize your marginal tax bracket. It is

anticipated that tax rates will be going up in the future and thus it could be

advantageous to fill up your tax bracket this year by accelerating income or

deferring deductions in the current year.

Taxpayers in the lower income tax brackets may be able to avoid tax on long-

term capital gains and qualified dividends by taking advantage of the zero

percent tax rate on capital gains and qualified dividends.

Preparing an income tax projection and knowing your expected marginal tax

bracket is a good start for year-end planning. You should discuss the planning

opportunities with your Tax or Financial Advisor who understands your

individual tax situation and can help to optimize your marginal tax rate. n

9