How to Approach the Proposed Tax Changes

It is hard to believe that the days are already growing shorter. Before we know it, the end of the year will be upon us, which means tax planning season is just around the corner. At present, there is much uncertainty surrounding the upcoming tax season. Earlier this year the Biden administration formally proposed several tax changes, some of which will be significant – especially to high income earners. Consequently, many taxpayers are wondering how they may be affected and what they should do considering the proposed changes.

At this point in time, we believe that making any decisions based on the proposed changes is still premature. The changes suggested by the Biden administration are not final, and it is possible that the provisions could change, or not be passed at all. That said, it is important to understand how the tax changes could impact you and what strategies you should consider should the proposed changes pass. While there are numerous changes proposed, we want to highlight three of the more significant changes that could impact you.

Increase in the Top Tax Rate

Proposal

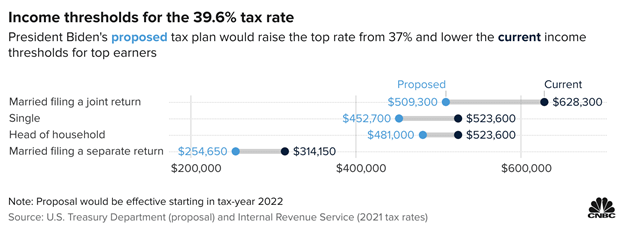

Reverse the tax cut applicable to the highest income taxpayers that was enacted via the Tax Cuts and Jobs Act of 2017. This would increase the federal top marginal tax rate from 37% to 39.6% and decrease the income thresholds for top earners. This change would be effective January 1, 2022.

Note:

Under current law, the top marginal tax rate is slated to revert to 39.6% for tax years beginning January 1, 2026.

Strategies to Consider

First, it is important to remember that federal income tax rates are marginalized, meaning that the tax increase only applies to your income over the top income threshold, not all your income. If you expect that your effective tax rate in future years could change, it may be prudent to accelerate, defer or offset some of your income.

For example, now may be a great time to consider a Roth conversion, which involves converting traditional IRA assets to Roth IRA assets. When you go through a Roth conversion, the amount you convert is treated as income in the year in which the conversion occurs. Once the assets are converted, your future taxable income would be reduced, as eligible distributions from your Roth IRA are not taxed. There are a number of considerations you should make before making a Roth conversion, many of which are outlined in this article from Fidelity.

Increase in the Capital Gains Tax Rate

Proposal

Increase the top capital gains tax rate for those earning more than $1 million per year. The current top tax rate on long-term capital gains and qualified dividends is 20%, plus a 3.8% tax on net investment income. The changes proposed by the Biden administration would increase this rate to the top ordinary income tax rate, which is proposed to be 39.6%. Once you add in the 3.8% surcharge, this would mean an increase in the top capital gains tax rate from 23.8% to 43.4%.

Strategies to Consider

There are various steps you can consider taking in 2021 to utilize the lower capital gains tax rates that are currently in effect. For example, if you have any significant cash needs for 2022, it may be worthwhile to consider selling highly appreciated securities in 2021 to meet those upcoming needs. If you have a business or rental property that you have been considering selling, it could be beneficial to complete that sale prior to December 31, 2021.

In addition, there are various charitable giving and asset location strategies that may be useful to consider in light of the proposed tax increase. For example, by donating appreciated securities to charity, you could avoid paying capital gains tax on the appreciation while also claiming some or all of the fair market value of the donated securities as an itemized deduction.

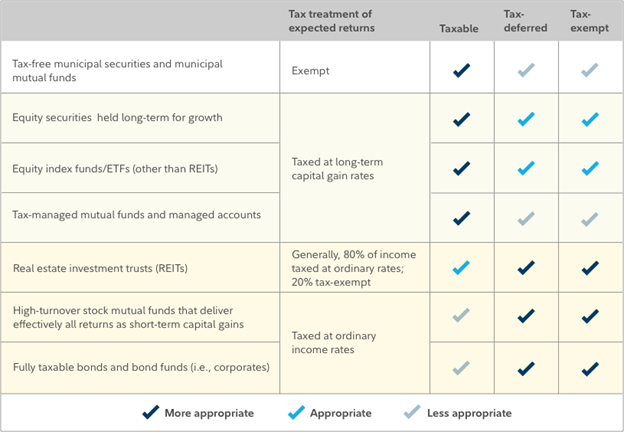

Asset location strategies recognize that “different investments are subject to different tax rules, and different types of accounts have different tax treatment.” By ensuring your investments are held in the account that is the most tax advantaged, you can potentially lower your overall tax bill. While each investor’s situation is different, this chart from Fidelity provides some general guidelines regarding which accounts are best suited for various investments:

Elimination of the Step-Up In Basis Rules

Proposal

Elimination of the step-up in basis for gains over $1 million per decedent. Under the current step-up in basis rules, when a beneficiary inherits an appreciated asset (e.g., stock, real estate, etc.), the cost basis of that asset is “stepped-up” to its fair market value at the time of the benefactor’s death and any appreciation realized on that asset prior to death permanently escapes capital gains tax. The Biden administration’s proposal eliminates the step-up in basis for gains over $1 million per decedent.

Strategies to Consider

There are various charitable giving strategies that could reduce the taxes owed by your estate. As noted above, by donating highly appreciated securities to charities, one may entirely avoid capital gains taxes on the appreciation.

In Conclusion

Again, it is important to remember that the proposed changes are just that: proposed. While it is good to start considering what strategies you may want to employ, for most we recommend waiting for now to see if and how the proposal changes and what provisions are ultimately enacted. Please reach out to us if there is anything we can do to help as you analyze the impact of the proposed changes on your financial situation.