Navigating Record Markets and Future “Risks”: 2024 Investment Strategies

Market performance in the first quarter of 2024 defied expectations. Following a strong 24% gain in 2023, the S&P surprised investors with a robust 10% increase for the quarter. The market’s strong start in Q1 is historically significant as there have only been four times since 2000 that the index has risen 8% or more in the first quarter. That strong performance creates questions regarding the market’s sustainability moving forward. How high can we go? When will the next correction be? Many pundits believe the market is overheated while others see a long runway of growth. Historically, strong Q1 returns bode well for the market. In nearly 94% of years where the S&P 500 rose by 8% or more in the first quarter, the index saw further gains over the rest of the year.

As 2024 unfolds, headwinds loom that could lead to increased market volatility. Geopolitical tensions and upcoming elections dominate the news cycle, with no immediate resolution in sight. Furthermore, most analysts now expect the Federal Reserve to maintain higher interest rates for an extended period. While positive signs exist – with the core CPI (Consumer Price Index) falling from a peak of 9.1% in June 2022 to 3.2% in February 2024 – the Fed’s target of 2.0% this year seems unlikely. Adding to concerns is the ballooning federal debt exceeding $34.6 trillion and a projected worsening budget deficit.

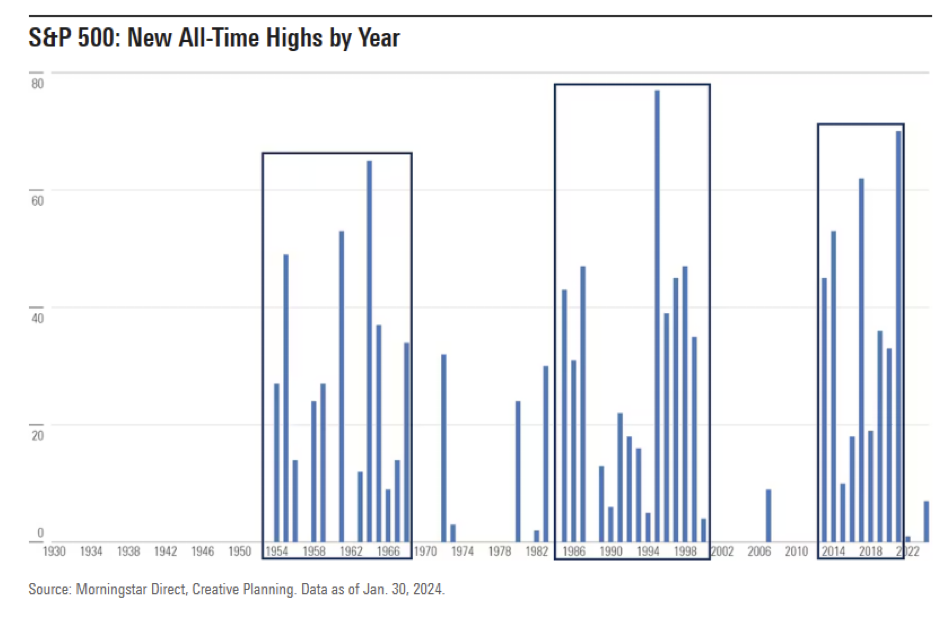

Despite these headwinds, some argue that historical trends favor continued growth. Since new highs often come in clusters, strong market performance might pave the way for more gains. Some studies suggest long-term returns are comparable, and sometimes even better, when investing at market highs versus random days. Additionally, the underlying economy shows positive signs with a robust labor market and continued consumer spending, despite rising credit card debt and delinquencies. This creates a complex situation for investors, offering both potential for optimism and reasons for caution.

With all of this going on, let’s address some common questions that may be on your mind:

Should I Invest When the Market Hits All-Time Highs?

History suggests that attempting to “time the market” by waiting for a dip is a recipe for missed opportunities. As shown in the chart below, the S&P 500 has consistently reached new highs throughout history, and even many times in the same year.

As Morgan Housel wrote, “All past declines look like an opportunity; all future declines look like risk.” Instead of trying to find the right time to invest, focus on a long-term investment strategy with a diversified portfolio. This means spreading your investments across different asset classes, such as stocks, bonds, and cash equivalents, to mitigate risk.

We also recommend you hold a reasonable cash reserve, which can act as a financial safety net by providing peace of mind and flexibility during market volatility or unexpected emergencies. As noted above, at present there are various economic factors at play that could introduce uncertainty, and that is generally the case in any given year. Having a cash reserve allows you to:

-

Manage emotional investing

Market volatility can trigger emotional responses, leading to impulsive decisions. A cash reserve helps you avoid selling investments in a panic during a downturn.

-

Cover unexpected expenses

Car repairs, medical bills, or sudden job loss can derail your investment plans. A cash reserve helps you cover these expenses without having to tap into your investments.

The amount you should keep in your cash reserve depends on your individual circumstances. A good rule of thumb is to have 4-8 months of living expenses readily available. This provides a buffer and allows you to weather unexpected storms without jeopardizing your long-term financial goals.

How will the Upcoming Presidential Election Impact My Investments?

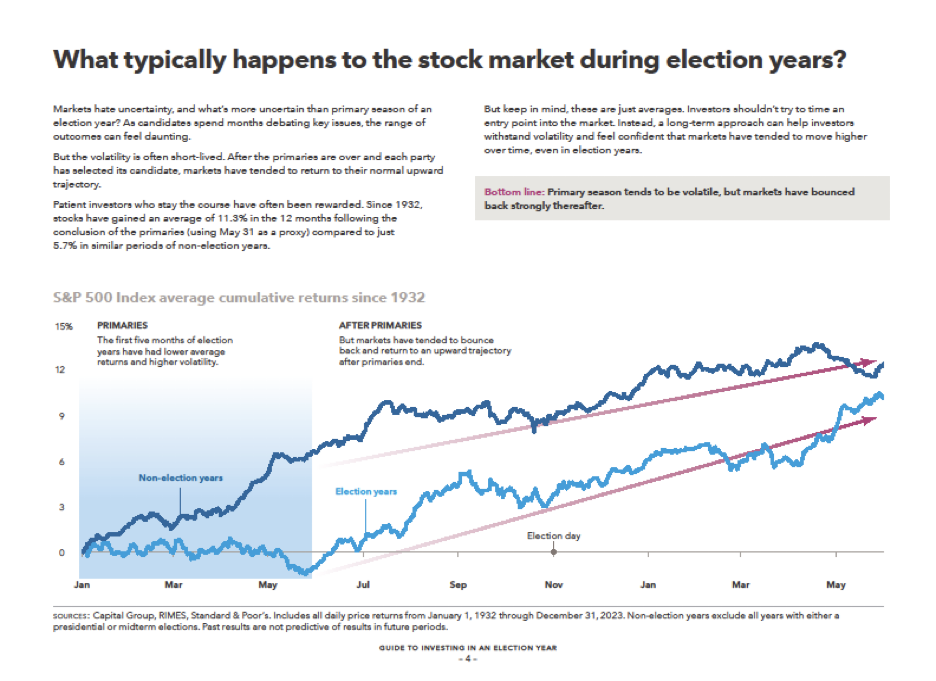

Another recent concern we have been hearing is “What happens in November?” Elections almost always introduce volatility into the market, but the impact is quite often fleeting. In Q1 2024, the market remained relatively stable despite the upcoming presidential election.

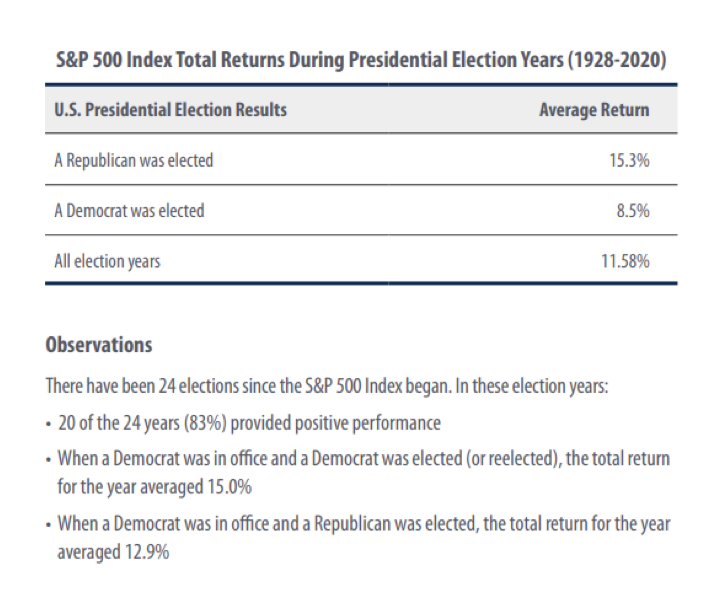

While many investors may feel nervous about their portfolio during a presidential election year, historically these years have provided positive gains for stocks. First Trust recently released the following statistics:

Source: First Trust Client Resource Kit – Election

We firmly believe the best course of action is to stay focused on your long-term goals and avoid making impulsive decisions based on election-related noise.

What Should I Do if We See a Market Correction?

A correction is a temporary drop in stock prices, typically around 10% from recent highs. While corrections can be uncomfortable, they are a normal part of the market cycle.

During a correction, resist the urge to panic-sell. Historically, markets have always rebounded. If you have a diversified portfolio, a correction should not significantly derail your long-term plans. Additionally, the financial plans we build for our clients assume that there will be market corrections, as we know this is an inevitable part of investing. Know that corrections happen and remember that your behavior during a correction can significantly impact your long-term financial success.

*****

While Q1 saw strong performance, we acknowledge that several factors could lead to a more volatile market throughout 2024. We remain committed to providing you with the guidance and support you need to navigate these challenges and stay on track toward your financial goals.