Retirement Cash Reserves and Buckets – Strategies to Improve Retirement Distribution Planning

By: Jamie Stone, Chief Planning Officer

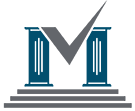

“Do I have enough?” This is probably the most frequent question I’ve received from clients over my career. And my clients aren’t unique. This is a common, and probably the most frequent, concern people have with their financial plan, as illustrated in the chart below that outlines common sentiments shared by investors:

Having “enough” seems like a simple enough question in the context of a financial plan, but, as with most things in life, it really can be a more complex question than people realize. I often tell clients that my main job, as a planner, is to account for longevity and inflation. In other words, my goal is to make sure clients don’t outlive their money due to the cost of goods and services going up over time.

But how do you balance out goals along the time horizon of a financial plan? A goal that happens once this year isn’t the same as a goal that will last from now until the end of retirement, and that isn’t the same as a goal that happens in 10 or 20 years.

Ideally, short-term goals would be protected from near-term risk and volatility, and long-term goals would be protected from the erosive power of inflation. One of the best ways to strike this balance within a plan is to have adequate retirement cash reserves and to use a buckets strategy.

Retirement Cash Reserves

“Water, water everywhere, nor any drop to drink.” I think this famous line from The Rime of the Ancient Mariner captures how some retirees feel during times of market volatility, especially if they’re taking systematic distributions from their portfolios for income. They feel they should have enough, but don’t want to draw from accounts that are temporarily down. Even a well-crafted plan that has assets in an allocation that fits the clients’ needs could still have periods when the investments are down. Because of this, clients could run the risk of selling investments at a loss or depressed prices as their regular distributions are taken. Depending on the timing of withdrawals and market volatility, this can have a real impact on the longevity of the portfolio.

How do we protect against this risk? Having adequate cash reserves at retirement can provide a buffer against short-term market volatility while clients are taking distributions. I tell clients it’s like turning off the spigot from their portfolio and drawing their regular “income” from their reserves until the portfolio has had a chance to recover. And it can make a difference. One study found that a 30-year plan with a one-year retirement cash reserve had as much as a 6% higher survival rate compared to a plan that just maintained the same distribution rate through market volatility.*

So, how much should be in one’s retirement cash reserves? That is a question best answered by each client’s individual needs and unique financial plan, but it is important to find a balance between mitigating short-term market risk and not being over-exposed to inflation risk. In other words, you don’t want too much of a good thing (cash).

One important factor to keep in mind is that the more conservative the household portfolio is, the less one may need in retirement cash reserves. This can be counterintuitive to clients who are more conservative investors, but I think this can be illustrated by looking at the downturn and recovery from the Great Recession from 2007 to 2009.

Time to recovery for a balanced (60/40 stocks/bonds) or conservative (40/60 stocks/bonds) portfolio was considerably shorter than the recovery for the overall market. So, retirement cash reserves may not need to be as great. Having one year of core retirement distributions set aside for retirement reserves is often appropriate for clients, but this must be confirmed by the client’s financial plan.

Buckets Strategy

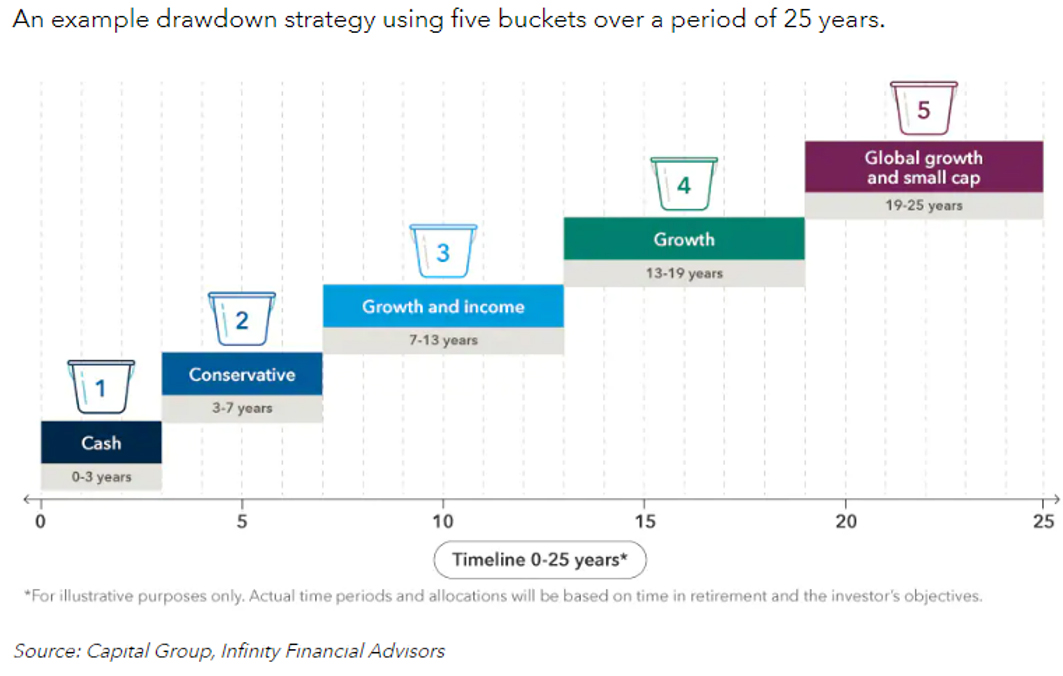

“Inflation is taxation without legislation” Milton Friedman. As I mentioned earlier, part of a well-crafted financial plan is finding a balance between protecting against short-term market volatility while maintaining overall plan longevity. And the longer a plan runs, the more of an impact inflation will have on the plan. But with a longer time-horizon, clients do have one important ally – time. So, for goals that are further out in the plan, it’s important that time is used to our advantage. That’s really all a buckets strategy is: it’s segmenting investment allocations by the time horizons of the goals in the plan. The further out a goal is, the more growth oriented the allocation can be for that bucket.

Using buckets gives a plan a great opportunity to outpace inflation for goals with a long-term time horizon. Volatility for buckets further out won’t be as much of a concern because they have time to recover and grow. More short-term goals are covered by buckets with less risk and, if needed, retirement cash reserves. The number of buckets, how much should go in each one, and how each bucket is invested is determined by the advisor and client as part of the client’s ongoing financial plan. Further, as time goes by, allocations within the buckets must be adjusted to reduce risk as the goals get closer to being fulfilled.

Retirement cash reserves and buckets strategies are just part of our holistic financial planning approach. At Means Wealth Management, we are committed to guiding clients as they work toward and achieve their financial goals. We stand alongside our clients throughout the life of their plan and are here to help in any way we can.

If you have questions or need clarification about your plan, please don’t hesitate to reach out to us.

*The Benefits of a Cash Reserve Strategy in Retirement Distribution Planning, Journal of Financial Planning, 09/13.