Page 27 - Means Wealth 2020/2021 Perspectives

P. 27

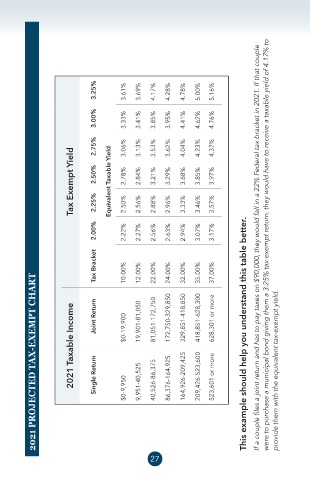

3.25% 3.61% 3.69% 4.17% 4.28% 4.78% 5.00% 5.16%

3.00% 3.33% 3.41% 3.85% 3.95% 4.41% 4.62% 4.76%

2.75% 3.06% 3.13% 3.53% 3.62% 4.04% 4.23% 4.37%

Tax Exempt Yield 2.50% 2.25% Equivalent Taxable Yield 2.78% 2.50% 2.84% 2.56% 3.21% 2.88% 3.29% 2.96% 3.68% 3.33% 3.85% 3.46% 3.97% 3.57%

2.00% 2.22% 2.27% 2.56% 2.63% 2.94% 3.07% 3.17% If a couple files a joint return and has to pay taxes on $90,000, they would fall in a 22% Federal tax bracket in 2021. If that couple were to purchase a municipal bond giving them a 3.25% tax-exempt return, they would have to receive

Tax Bracket 10.00% 12.00% 22.00% 24.00% 32.00% 35.00% 37.00%

2021 PROJECTED TAX-EXEMPT CHART

2021 Taxable Income Joint Return Single Return $0-19,900 $0-9,950 19,901-81,050 9,951-40,525 81,051-172,750 40,526-86,375 172,750-329,850 86,376-164,925 329,851-418,850 164,926-209,425 418,851-628,300 209,426-523,600 628,301 or more 523,601 or more This example should help you understand

27