Tax Law Changes and Summer Tax Strategies

Tax Law Changes and Summer Tax Strategies: Financial Planning Moves to Consider Before Fall

Most years, summer is a time when tax season might feel far off. However, with the signing of the One Big Beautiful Bill Act (OBBBA) on July 4th this year, the months of August and September could be ideal for making thoughtful, proactive decisions—without the pressure of an April deadline.

Before we run through mid-year tax planning strategies, here’s a quick look at a few of the key provisions in the OBBBA that may impact individual taxpayers. While this list doesn’t cover every tax law change, we are highlighting the updates we feel could be most impactful to our clients this year:

1. Existing Federal Marginal Tax Rates made Permanent

The current marginal tax rates—originally set to expire at the end of 2025 —have been made permanent, avoiding a reversion to the higher pre-2017 Tax Cuts and Jobs Act (TCJA) rates.

2. Increased State and Local Tax (SALT) Deduction

The SALT deduction maximum will increase from $10,000 to $40,000 for taxpayers with adjusted gross income (AGI) less than $500,000, starting in 2025 and continuing through 2029. The limit will be adjusted annually for inflation.

3. Permanent Increase to the Standard Deduction

The higher standard deduction established by the TCJA is now permanent, with an additional inflation adjustment for tax years 2025 through 2028.

4. New Enhanced Senior Deduction

Taxpayers age 65 and older with an AGI of up to $75,000 (single/head of household) or $150,000 (married filing jointly) will receive an additional $6,000 per person deduction. This is in addition to the standard or itemized deduction available to filers age 65 and older. The deduction is phased out between $75,000-$175,000 for single/head of household and $150,000-$250,000 for joint filers.

5. Increased Child Tax Credit

The Child Tax Credit will increase to $2,200 for 2025, with additional inflation indexing starting in 2026. The credit phases out from $200,000-$243,000 AGI for single and head of household filers, and $400,000-$443,000 for those married filing jointly.

6. Higher Estate Tax Exclusion

The lifetime exclusion for federal estate taxes will increase to $15 million per taxpayer, with permanent annual inflation adjustments going forward.

These are just some of the tax law changes in the OBBBA, but there are many other changes in this very large bill (it’s right there in the name). There are also additional deductions on tips, overtime, auto loan interest (2026), and non-itemized charitable giving (2026), a mortgage interest deduction limit change, expanded qualified 529 plan expenses, and new “Trump Accounts” for children under 18 years old.

It may be important to have a conversation with your tax preparer about how the OBBBA could change your taxes in 2025. We also serve as a resource for our clients’ tax planning needs.

In light of these changes, here are a few mid-year tax strategies worth considering now, while there’s still plenty of time to plan intentionally:

1. Track Eligible Expenses that Could be Itemized

With the increased SALT deduction, some higher income taxpayers in higher tax states may benefit more from itemizing deductions instead of taking the standard deduction. But that benefit only applies if you can track and verify eligible expenses. The good news: many of these can be tracked online or with tax reporting forms you’ll receive. If you think you may itemize your deductions, it’s a good idea to start mapping out what eligible deductions you may have and how you will get the needed information for your taxes.

2. Get Strategic About Roth Conversions

If your income is temporarily lower—or the market has given you a window of opportunity—it might be the right time for a Roth conversion. Converting pre-tax IRA dollars to a Roth IRA means you’ll pay taxes now but could enjoy tax-free growth and withdrawals later. Summer is a great time to model the potential impact and decide if it makes sense in your broader plan.

3. Start Early on Required Minimum Distributions (RMDs)

If you’re age 73 or older (or inherited a retirement account), you’re likely required to take distributions this year. Instead of waiting until December, planning now can give you flexibility. If you’re age 70 ½ or older, you might also explore a Qualified Charitable Distribution (QCD), which allows you to donate your RMD (or more, up to $108,000 in 2025) directly to a charity, tax-free.

4. Consider a Donor-Advised Fund (DAF)

Charitable giving can be both meaningful and tax-efficient. If you plan to make significant donations this year, consider using a donor-advised fund to bundle multiple years of giving into a single, potentially tax-deductible, contribution. This strategy is especially helpful in high-income years or if you’re itemizing deductions in 2025.

5. Check Your Tax Withholding

In addition to tax law changes, life changes—job shifts, bonuses, extra income—can throw your withholding out of sync. A quick mid-year check-in can help ensure you’re on track and prevent surprises at tax time. This is especially relevant if you changed jobs or had any large income events this year.

6. Make the Most of Estimated Tax Payments

If you’re self-employed, retired, or earn income outside of regular wages, estimated tax payments can be an important part of avoiding surprises next spring. If your income has shifted, now is a good time to revisit your quarterly estimates and adjust as needed—especially before the next due date hits.

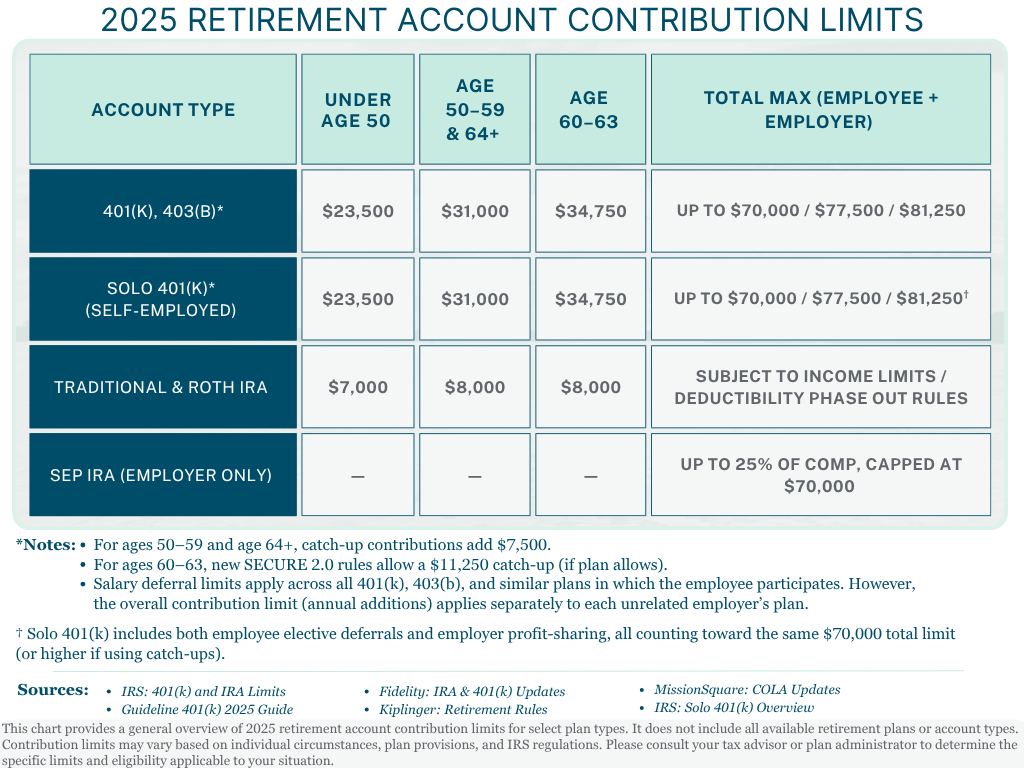

7. Max Out (or Catch Up) on Retirement Contributions

Don’t wait until year-end to think about retirement contributions. Whether it’s a 401(k), 403(b), IRA, or SEP, contributing steadily throughout the year can help maximize savings and manage cash flow. And if you’ve received a mid-year raise or bonus, bumping up your deferrals now can make a big difference.

Need Help Prioritizing?

Tax planning doesn’t have to be overwhelming—or left until the last minute. If you’d like to talk through what’s most relevant to your situation, we’re here to help. We’re happy to collaborate with your tax professional to ensure you’re making the most of the months ahead.

Means Wealth Management is a registered investment adviser. The opinions expressed herein are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. The information in this material is for educational purposes only, is not intended to predict or guarantee future market performance, and is not intended to act as individualized tax, legal, financial, or investment advice. Data contained herein from third-party providers is obtained from what are considered reliable sources. Means Wealth cannot be held liable for the accuracy, time-sensitive nature, or viability of any third-party information provided. Please consult a qualified attorney or tax professional for individualized legal or tax advice. Please contact a financial advisor for specific information regarding your individualized financial and investment planning needs.