A Rough Year

There is a lot of fear in the stock market and the world right now. Since I started my career here in 2009, this is the most pessimistic I have seen clients, other advisors, economists and talking heads. No doubt, there are a lot of concerning things happening, so I thought it would be helpful to touch base and provide some insight.

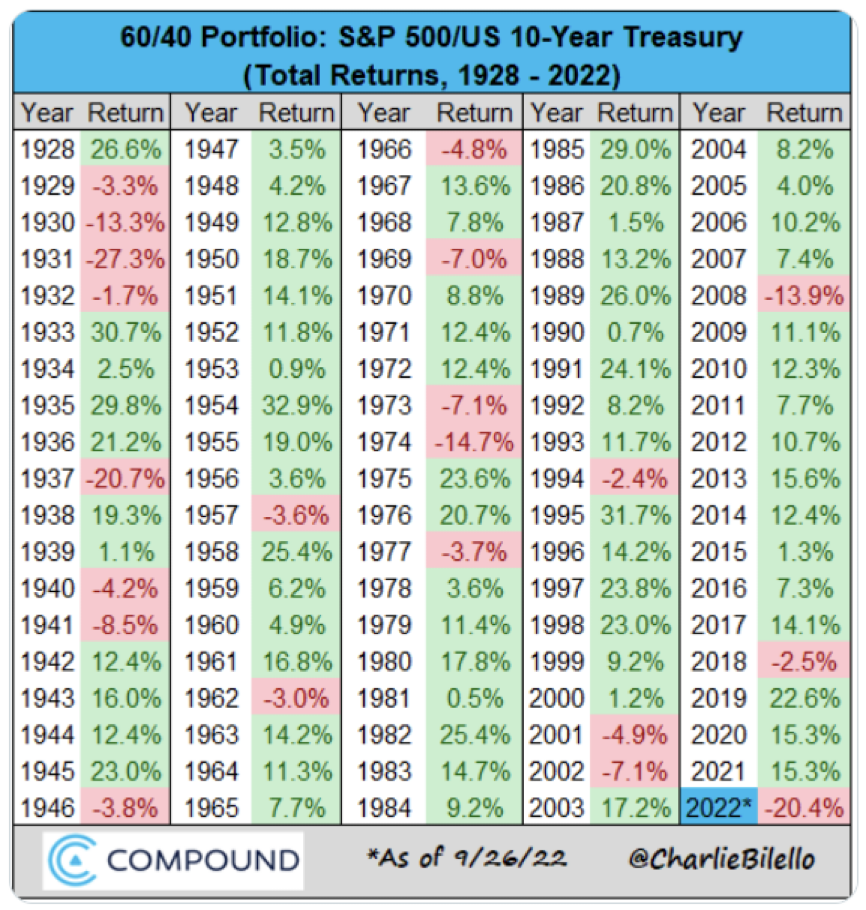

As it stands today, a benchmark portfolio with 60% stocks and 40% bonds is on pace for its second worst year in history—currently down over 20%. The worst year was 1931, when that mix was down over 27%.

Since 1976, this is the first time stocks and bonds are both down more than 10% in the same year. According to Callan Research, there have only been two years in history that stocks and bonds have both been down in the same year (1931 and 1969).

What’s happening in the bond market?

Portfolios are generally constructed with bonds in them to protect some of the downside. The concern for many clients is that their lower-risk investments, the bonds in the portfolio, are meant to hedge or reduce risk. Unfortunately, that hasn’t been the case in 2022. Much of this is because of what’s called “mark-to-market” pricing.

What is mark-to-market for bonds and how does it impact me?

Bonds are debt instruments, similar to IOUs. Someone pays you X% for the ability to borrow your money for a predetermined period (known as maturity). The hope in having someone borrow the funds from you is that you’ll earn a reasonable rate of return and get 100% of the principal back. As it relates to bond price movements, bonds and interest rates have a negative correlation. When interest rates go up, bond prices (values) go down. As a basic example, if I purchased a bond yesterday that would pay me 3% and can purchase a very similar bond today that pays me 4%, the bond I bought yesterday is less valuable, right? That doesn’t necessarily mean that I am not going to earn my 3% and get my initial investment back, but it did create some price fluctuation on the bond I bought yesterday.

Given that interest rates have gone up so quickly over the last 6 months, bond prices have retreated. If you had to sell your bonds before they mature, they would price at “mark-to-market” and you would lock in a loss. Monthly statements show the current fair market value of your holdings, which means any bond holdings that show on your monthly statements reflect how they would “mark-to-market” at the end of the statement period. However, if you hold them to maturity, and there is no default or premature sale, you will get 100% of your principal back along with the interest promised (i.e., that “mark-to-market” adjustment disappears).

There is hope in the bond market.

Rising rates for bonds isn’t always bad news, though. For those clients that are reinvesting their interest back into the positions, as interest rates rise, clients will get paid more for holding these securities which will add to total return. Just 6 months ago, the bond market yields looked like this:

- Short term govt bonds: 0.3%

- Corporate bonds: 2%

- High-yield bonds: 3%

And today, those yields look like this:

- Short term govt bonds: 4%

- Corporate bonds: 5+%

- High-yield bonds: 8+%

We most likely haven’t seen the end of this upward trend in bond yields.

What about the stock market?

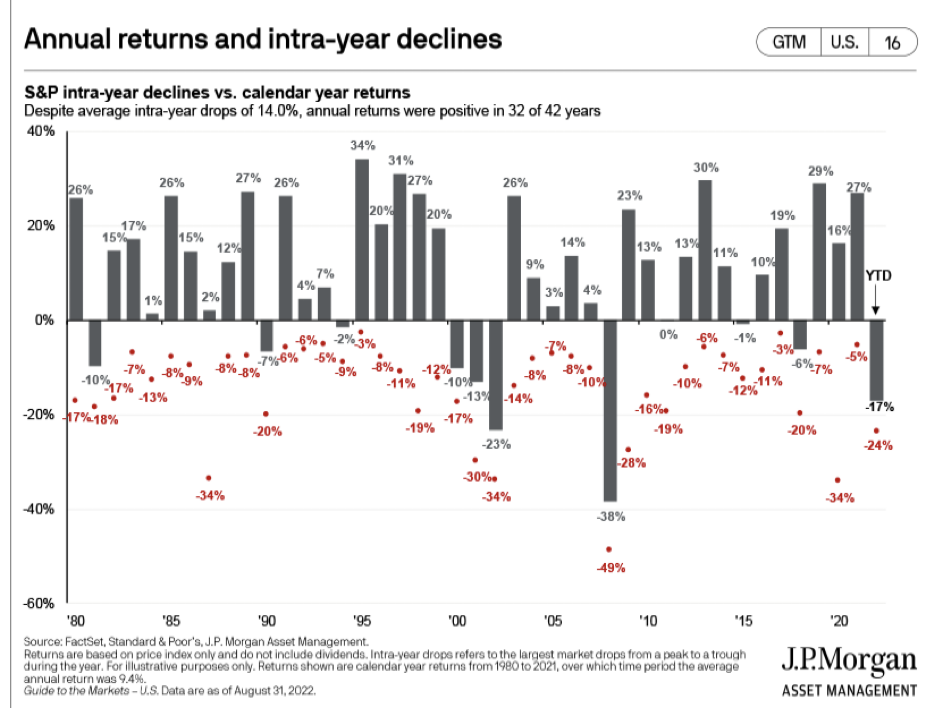

Just like the bond market, the stock market has not reacted well to rising rates. The Fed has made it very clear that they will do whatever they can to slay the inflationary dragon—even if it is at the cost of stock market gains. I believe that once we see inflation start to curb, the market will regain solid footing. Until then, we are most likely in for some additional turbulence. The average bear market lasts 289 days so it may take some time to see all-time highs again, but we inevitably will.

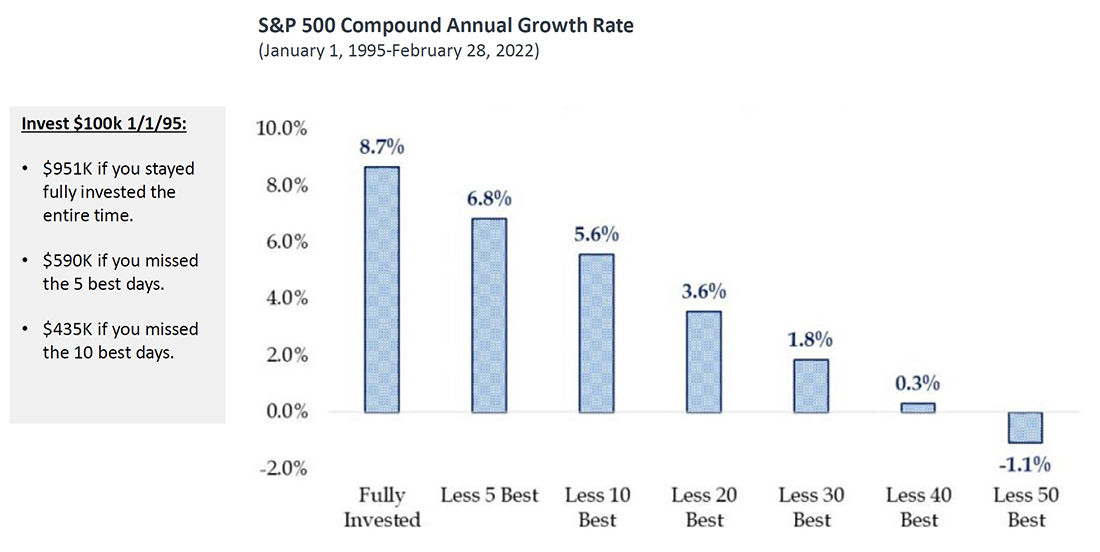

While investing in the stock market does not carry the same risk profile as the bond market, remember this: bear markets do happen. History has shown us that bear markets are always followed by something we love: recoveries. We recently received this chart from our partners at Fidelity Investments, which reminds us of the effects of missing out on a rebound rally, which we expect is in our future (we just don’t know when):

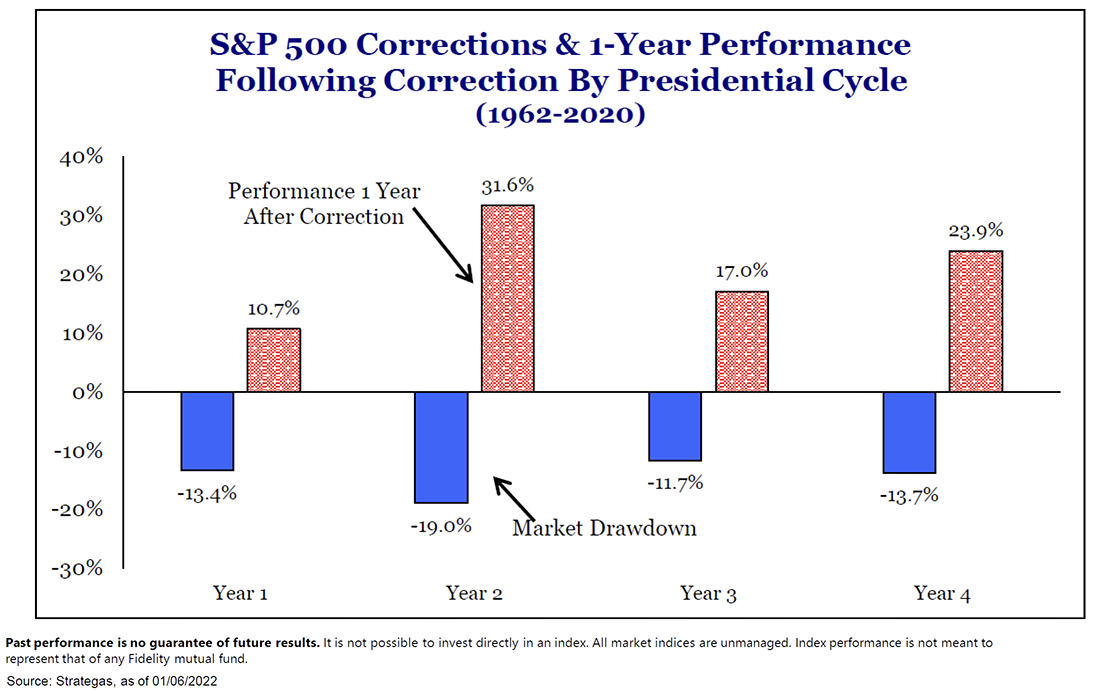

They also shared this chart with us to remind us that the current volatility we are seeing within the stock market is actually typical for a mid-term election year:

What does this all mean? While past performance is no guarantee of future results, history does tell us that there should be positive returns on the horizon, we just don’t know when they will come or how great they will be. What we do know is that we don’t want to miss out on them.

Now what?

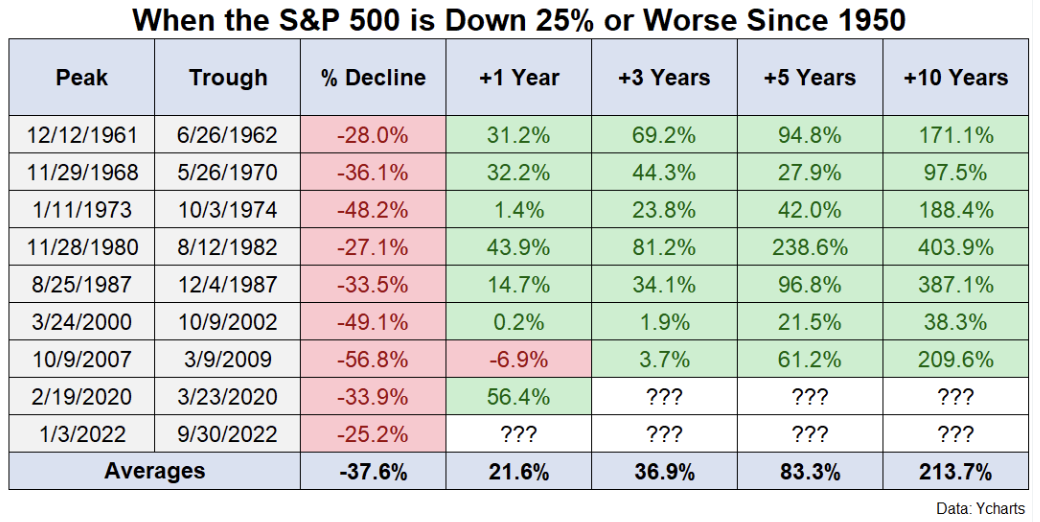

Our advice remains: stay the course—we will get through this. We have had drawdowns in the past but time in the market matters more than timing the market:

Remember, we are here actively watching the news, the markets, and your portfolio, and we are continually considering what actions need to be taken, if any. We do all this remembering that actions taken before and during a market pullback can have a significant impact on one’s overall financial success.

Please reach out if you have any questions or concerns.