A Year of Change

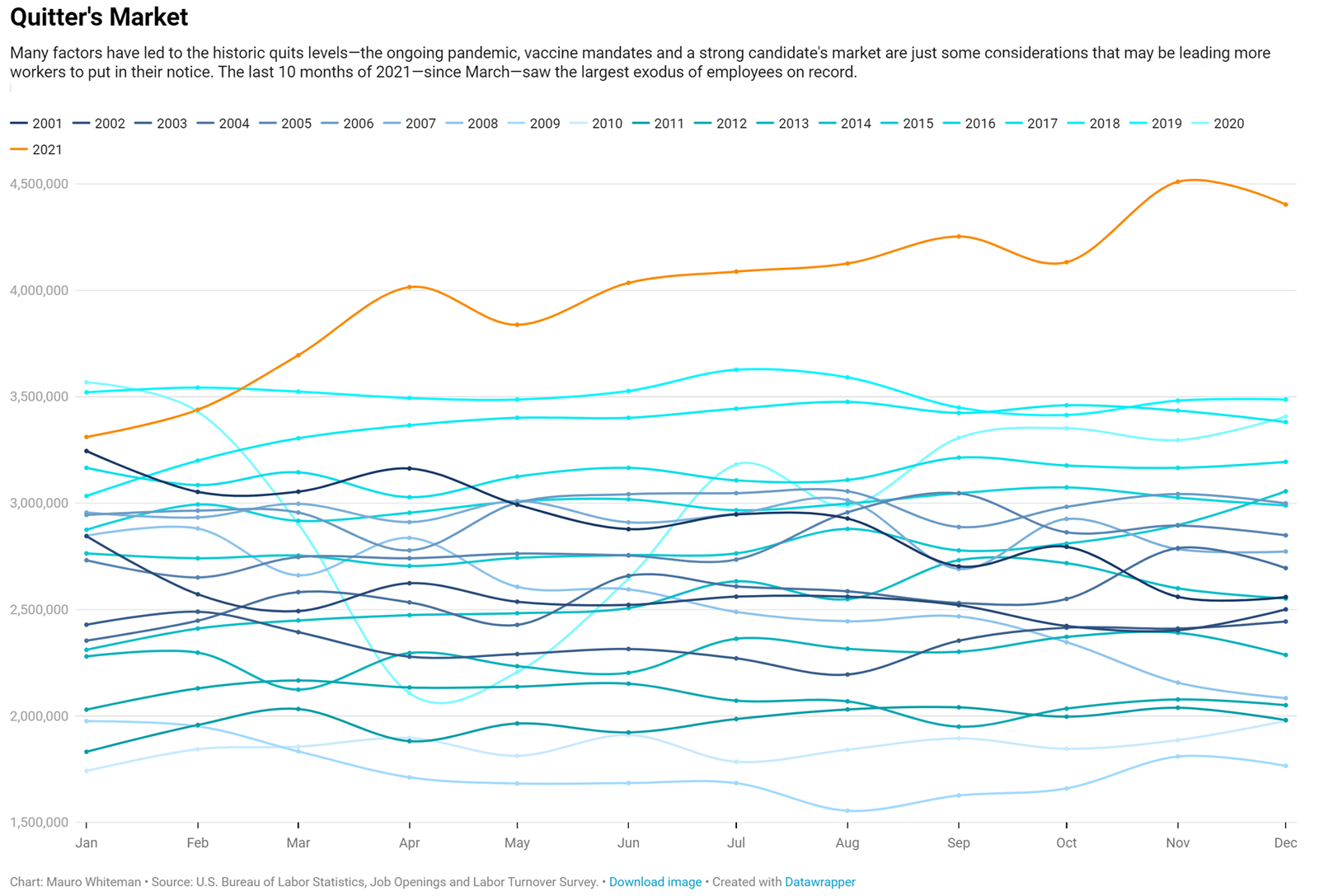

At this point, you likely have heard of the term “The Great Resignation”, which refers to the sudden surge in workers leaving their jobs in 2021 and 2022. According to the U.S. Bureau of Labor Statistics, the number of resignations (also known as “quits”) rose to a high of 4.5 million in November of 2021. Since November, the quit rates have remained above 4.2 million per month. These rates are unprecedented; in fact, PwC’s recent Global Workforce Hopes and Fears Survey revealed that one in five workers globally plans to find a new employer in the next twelve months. In addition, the tight labor market means that job seekers are at an advantage, as employers have had to implement strategies to remain competitive when hiring.

Source: SHRM

So, what if you or someone you know is considering making a change? While changing jobs involves many factors not exclusive to finances, there are a few key fiscal areas that should be considered before making a change. There are also areas to review after you may have decided to change careers.

1. Budget Impact

Changing a job can result in a major change for your budget, and not necessarily in an adverse way. Does your current budget reflect an increase or decrease in monthly income that could result from the proposed career change? If a decrease in income is expected, it is important to reflect this in your budget to see if your budget still works. If an increase is expected, updating your budget is equally as beneficial as this may be a great time to increase your retirement savings, pay down existing debt, build your savings, or shore up your emergency fund.

2. Reserve Funds

Having reserve funds is very important to all individuals, but especially as you begin to look to change careers. For most people, we recommend having 4-8 months of expenses saved at the bank or in very low risk investments. Keep in mind this is a general rule – you should adjust this target based on your individual circumstances and/or comfort level. Knowing what these funds could potentially be used for is also particularly important. Take into consideration things such as student loan payments, vehicle debt, and mortgage payments, as well as unplanned expenses such as house and vehicle repairs.

3. Rollover of Employer Sponsored Retirement Plan

If you change careers, and chances are you may do this more than once in your lifetime, your previous employer’s(s’) retirement plan may be able to be rolled into your new employer’s plan or a different retirement vehicle. You typically have four options as it pertains to funds held in a retirement plan at your former employer. You can:

-

- Leave the money in your former employer’s plan.

- Roll over the money to your new employer’s plan, if that new plan allows transfers.

- Roll the money into another retirement vehicle (such as a Traditional or Roth IRA).

- Cash out the account(s) (Remember: the amount cashed out could be reduced by a potential penalty of 10% for an early withdrawal, as well as state and federal taxes. Additionally, your savings will no longer grow tax-deferred and withdrawing your money may impact whether you have enough for retirement.)

There are pros and cons to each option, and we recommend you speak with your financial advisor as you consider how to address funds held in any of your previous employers’ retirement plans.

4. Insurance

A very important benefit most employers offer is insurance, such as health, dental, vision, etc. When you leave a job, your insurance coverage typically ends the month you leave unless negotiated with the employer. That does not mean that you are without options for insurance though. There are two primary options that you can take advantage of if you find yourself with a gap in your insurance coverage.

a. COBRA

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. This piece of legislation was designed to give workers the ability to cover themselves and their qualified dependents temporarily by extending health insurance coverage after separation from a job and before new coverage takes effect. COBRA is designed to allow employees to pay the full premium for group health coverage. Keep in mind that this coverage may be more expensive compared to what you paid while employed because your previous employer most likely paid a portion of the premium on your behalf.

COBRA typically covers private-sector employers who have 20 or more employees, or state and local governments. This law does not cover plans sponsored by the Federal Government or by churches and some church related organizations. If you cannot take advantage of COBRA due to being employed by a small employer (under 20 employees) your individual state may have their own variation of COBRA sometimes called mini-COBRA.

b. The Marketplace

If COBRA still is not an option, or even if it is available to you, you can still review your health options through the marketplace. Most states have their own exchanges which can be found at healthcare.gov. Through this website you will be directed to your state’s exchange where you can review the options available to you for health insurance. The exchange will also discuss the possibility of premium reductions due to your income and household size. It is a good idea to compare your coverage options through both COBRA (if available) and your state’s health insurance marketplace.

5. Other Benefits

The final financial piece of the puzzle is to determine if there are any discounts or benefits that you may need to begin to cover on your own. These could be something obvious, like your previous employer supplied you with a cellphone that you now need to pay for on your own. You also may have received benefits that are less obvious, such as an on-site gym that you used frequently so that you would need/ want to replace with a membership to a new gym.

No matter if you are just starting out in your professional life or have been with the same company for a long time, making a change in your career is a decision that should not be taken lightly (this does not mean that it cannot be exciting at the same time!). With the right plan, sound advice, and some self-reflection, you may just make the best decision yet in your professional life.

As always, thank you for reading and please contact us if you have any questions.