2022 Volatility and The Long View

“All past declines look like an opportunity, all future declines look like a risk”

—Morgan Housel

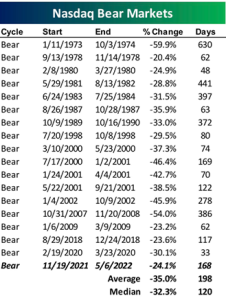

To say 2022 has been a difficult year for the stock market would be an understatement. As of its close on Friday, May 6th, the S&P 500 index was down 14% from its all-time high which was set earlier this year on January 3rd. Also as of Friday, the NASDAQ was down over 22% for the year, and down 24.1% from its all-time high on November 19, 2021. We surmised that volatility would be at play in 2022 and as investors we know that market pullbacks are to be expected, but that still doesn’t always make periods like this easier to stomach.

As Michael Antonelli of Bull and Baird said, “behavior matters more than financial knowledge.” In times like these, we encourage clients to disconnect, ignore the noise and stay the course. Easier said than done, right?

The markets very well may continue downward—nobody truly knows for sure. What we do know is that history has provided a significant amount of data for corrections and recoveries. If we look at the S&P, we’ll see that, since 1950, corrections in the S&P between 10 and 20% have never taken longer than 9 months to recover. As for the NASDAQ, we are now over 170 days into its bear market. If we look at historical trends, we’ll see that we are approaching the average time-period for a NASDAQ correction to last.

This isn’t to say for sure that we are bottoming now. However, our feeling, based on the health of the economy and Q1 earnings, is that we are closer to the bottom than most would think. So far, for 2022 Q1, 79.9% of companies that have reported earnings reported above analysts’ expectations. This is above the 66% long-term average (Refinitiv).

(Source: SPAR, Factset Research and MFS)

(Source: SPAR, Factset Research and MFS)

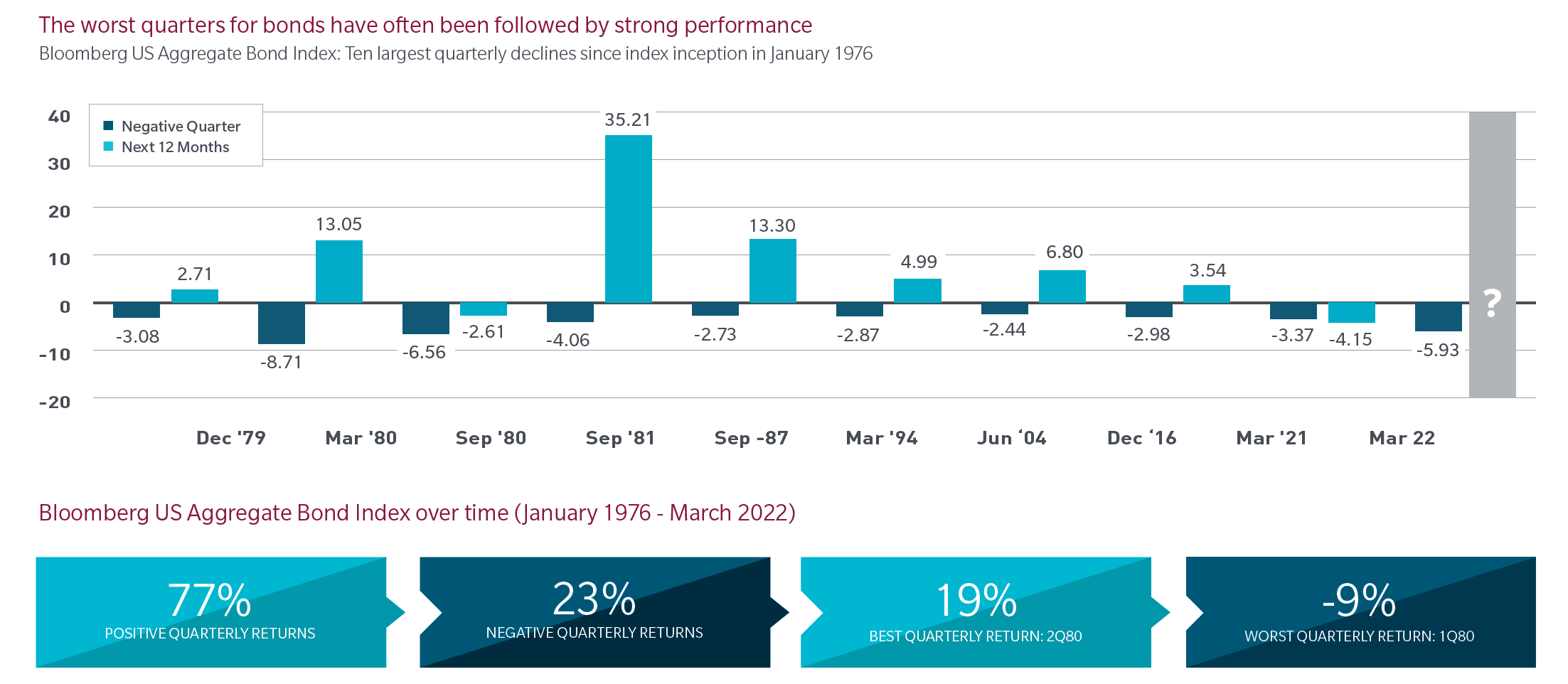

It isn’t only the stock market that is having a rough go of it. Even the “safer” assets, like fixed income (bonds), are down for the year, too. The US Agg, the benchmark for the bond market, is down over 10%. For anyone holding individual bonds, please remember: bonds mark to market, which means that as long as there is no default and you hold them to maturity, you will get your money back plus the interest payments. This means that bonds may still be a good investment should patience prevail.

Statistics are fun and they can help to allay concerns, but we think the real question on investors’ minds is: what should we do now? In addition to staying the course, here are some considerations:

- Nibble

- If you have cash that you have set aside for long-term needs, consider putting some of it to work in the market. Currently, we believe there are sectors in the market that are oversold (tech, healthcare, biotech), and buying high-quality companies with income growth and strong balance sheets could pay off. A 20% correction may just be a 20% sale if you are willing to wait long enough. If you do this, we recommend setting guidelines (amount, frequency) and sticking to them.

- If you are uncomfortable with the stock market but have longer-term funds that you want to invest and earn more than cash, you could consider buying some I Bonds, which are currently paying 9.62%. Please note there are limitations surrounding the purchase of I Bonds, which you can learn about here .

- Retirement Accounts

- Consider increasing your retirement account contributions. We know it is a difficult time for everyone, but a few additional dollars now into your 401k/403b, SIMPLE, etc., can make a big difference long-term. Certainly, don’t stop contributing—now is the time to be diligent about those contributions. Remember, many employers offer a match, so ensure you are contributing appropriately to maximize the match; it’s free money.

- Outside of workplace retirement plans, you or your spouse may be eligible to make a SEP, Traditional IRA or Roth IRA contribution. Please ask your accountant or work with us to see if a contribution into one of those retirement accounts would be right for you.

(Source: @visualizevalue)

- College/529 Accounts

- Consider contributing to college plans (529) for the little ones. Whether you are a grandparent, parent or friend of a child, now would be a great time to consider putting away some money for education. Contributions to 529s grow tax-free as long as withdrawals follow certain guidelines (learn more on pages 26-27 of our 2021-2022 Perspectives).(Source: @visualizevalue)

- Roth Conversion

- Consider converting your IRA to a Roth IRA. Your investments are down and perhaps your income will be lower this year. Moving a portion of pre-tax dollars into after-tax dollars could benefit you in the long run. Don’t forget, you will owe taxes on the amount converted and we recommend covering that tax bill with existing cash in a separate account.

As advisors, we are here to help you through times like this. We are actively watching the news, the markets, and your portfolio, and are meeting regularly to review actions we need to take if any. Like you, we hope this volatility will slow soon, but we cannot guarantee it will. In the meantime, please remember that we are only a phone call, email, or visit away should you need some reassurance or advice.