Investing in an Inflationary Environment

Most of us notice the rising cost of our grocery bills. We pay more for gas. Anyone undertaking a building project sees that the price of building materials soared. These rising costs lead many to ask, “Is this inflation?”

What should I do?

Let’s start with a quick primer on inflation itself. Inflation refers to the rise in the price of goods and services over time. In turn, this causes one’s purchasing power to decrease.

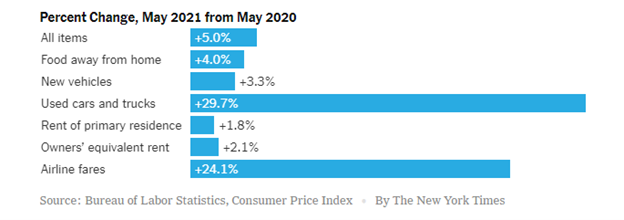

The U.S. Bureau of Labor Statistics (BLS) uses the “Consumer Price Index” (CPI) to measure and report on inflation. The CPI, calculated monthly, measures the change in prices over time for a theoretical basket of goods and services.

Fears of inflation and hyperinflation loomed for some time. They escalated this month when the BLS reported that consumer prices rose at their fastest pace (+5%) since 2008.

Why are we here?

There are a whole host of factors. Many relate to the COVID-19 pandemic. Consider this example. From January 2015 to February 2020, the personal saving rate averaged 7.4%. It averaged 18.3% from March 2020 to April 2021.

The percentage of consumers’ disposable income saved, as calculated by the U.S. Bureau of Economic Analysis and reported monthly. The personal saving rate has been in double digits since March 2020, when the pandemic hit.

What does this mean?

As COVID-19 restrictions ease and the economy reopens, consumers want to start to spend some of their savings. Couple this with supply chain shortages leads many to believe that we quickly arrive at that textbook definition of inflation, “too many dollars chasing too few goods.”

However, the Federal Reserve expects that this period of inflation we are in is “transitory,” or temporary. It should subside as pent-up demand subsides. At Means, we cannot predict how long these inflationary pressures last or how high inflation may go. However, we can help to answer how one might respond to the threat.

As investors, we need to consider inflation when building our financial plan. Most of us hold the same, basic long-term objective to maintain or increase our purchasing power. This means our investment returns must meet or beat inflation. If we invest in such a way that our returns average 1% a year, but inflation is 2%, our purchasing power decreases.

This means that most of us should utilize an investment mix that outpaces inflation. Certain investment vehicles tend to be better suited to do that. Stocks, for example, tend to meet or beat inflation over the long term.

Generally more than bonds or cash. That’s not to say there isn’t a place for bonds or cash in your investment portfolio. It all depends on your short and long-term cash flow needs and financial goals.

What’s one to do?

Whether or not we are in a period of inflation, the general investor’s primary goal has not changed. Invest assets in such a way that you achieve financial goals without taking on unnecessary risk.

At Means, we want to ensure that your strategies are based on your financial plan. Inflation is just one factor we consider. Adjustments to those investment strategies may be necessary. However, you must make those adjustments in a measured way, not in response to short-term economic events.

Disclaimer

Means Wealth Management is a registered investment adviser. The information in this material is for educational purposes only. It is not intended to predict or guarantee future market performance. It is not intended to act as individualized tax, legal, financial, or investment advice.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Please consult a qualified attorney or tax professional for individualized legal or tax advice. Please contact a financial advisor for specific information regarding your individualized financial and investment planning needs.