Investing at All-Time Highs

“I have some extra cash. What should I do with it?” Or, “I don’t want to invest right now. The market is too high. A correction is coming.”

As advisors, we’ve heard questions and statements like this a lot lately. With historically low interest rates, most people recognize that it may not make sense to leave excess funds in the bank.

With markets at all-time highs, many feel uncomfortable with the idea of investing extra cash. Perhaps you’ve heard the term “FOMO.” It stands for “fear of missing out.” We all experience it. It’s human nature. As advisors, we see FOMO often.

Clients call to tell us that they heard a hot tip from their neighbor on a stock they made 100X on. They want in. Or, they need to buy a property because they heard it’s such a great deal. They know they can turn it for quick cash.

Another acronym we could coin is “FOR” or “fear of regret.” Remember how nervous you were to make your first big purchase? The uncertainty of possibly overpaying for a new car, buying a home in the wrong neighborhood, or making the wrong decision, in general, can be nerve-wracking.

Why does something as exciting as all-time highs in the markets elicit such a nervous response?

It’s FOR at play. Many investors feel like they missed the opportunity to get in on the action. Others feel like with the markets this high, there’s no way they could go higher. Some would rather wait for another pullback and then invest.

If this is you, take a look at our article “Speculation is Not a Plan.” Investors are afraid of making the wrong decision and regretting the outcome. We want to challenge you to think of all-time highs in a different light.

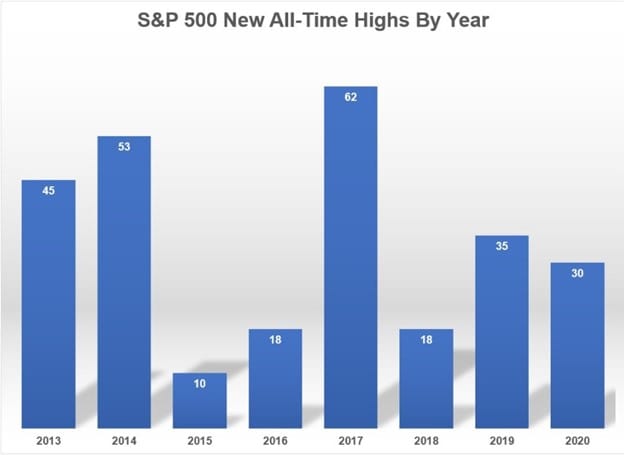

Most acknowledge that market corrections are an inevitable component of investing. That certainly is true. However, new all-time highs happen more than you think. Would you be surprised to hear that the S&P 500 have seen more than 270 new all-time highs since 2013?

Source: www.awealthofcommonsense.com

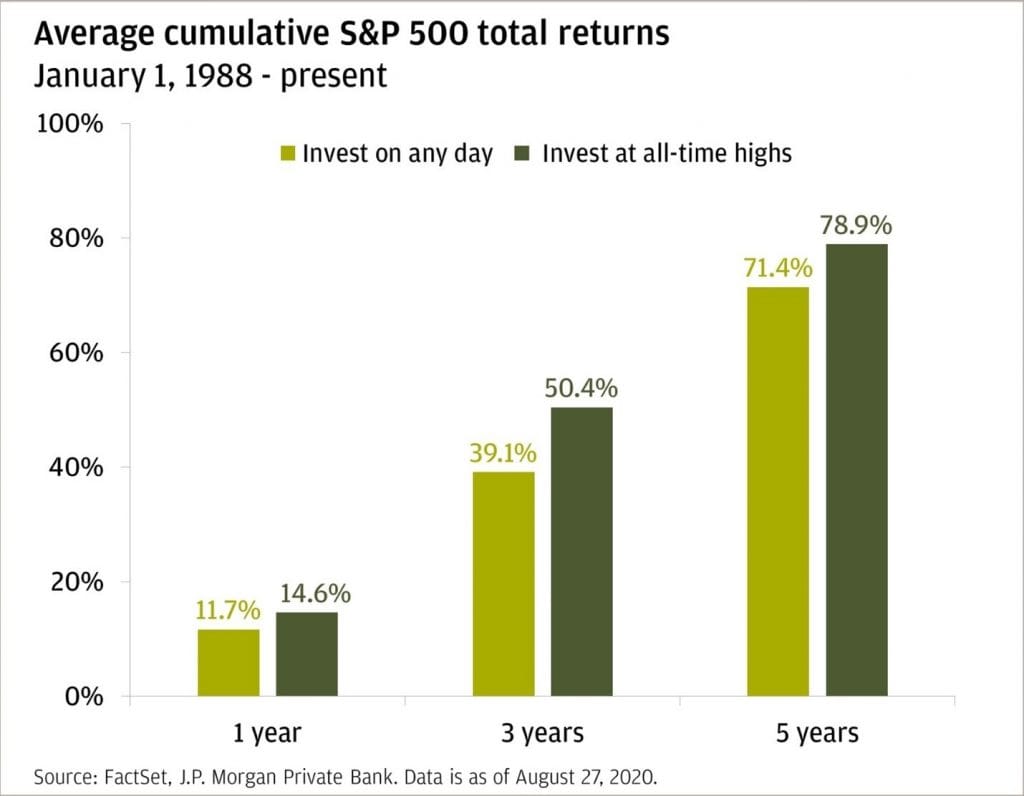

In August 2020, J.P. Morgan released an article discussing investing during all-time highs. Within the article, J.P. Morgan compared two hypothetical investors. The first invested in the S&P 500 on any random day from January 1, 1988, to August 27, 2020.

The second only invested on days when the S&P 500 closed at an all-time high. Remarkably, the investor who invested only during all-time highs did better.

Is there the chance that the markets could enter a correction just after you invested during all-time highs?

Absolutely! This is why we believe in the importance of a financial plan that considers your short and long-term needs as you determine if, how, and when to invest.

Assuming investment decisions are made in the context of your overall financial plan, the odds are in your favor if you take the long view, regardless of how the market performs on the day you invest.

Means Wealth Management is a registered investment adviser. This material’s information is for educational purposes only and is not intended to act as individualized tax, legal, financial, or investment advice. Data contained herein from third-party providers is obtained from what are considered reliable sources.

However, its accuracy, completeness, or reliability cannot be guaranteed. Past performance is no guarantee of future results. Please consult a qualified attorney or tax professional for individualized legal or tax advice. Please contact a financial advisor for specific information regarding your individualized financial and investment planning needs.