Presidential Election & the Stock Market: What History Tells Us

By: Zachary Means, CEO

Source: DFA Funds

It was election day 2016. I’ll never forget watching the news stations read off which candidate, Clinton or Trump, won each state. Massachusetts went to Clinton. Florida went to Trump. It was neck and neck. I flipped from one major news network to another. I was most interested in CNBC, where talking heads discussed the impact of the election on the markets.

As it became clear that Trump was headed to victory, the “pre-market” or “futures” that indicate how the markets will open the next day at 9:30 AM EST swung wildly, mostly in the red. As night turned into morning and the futures moved down 5%. This caused a trading halt.

I set my alarm for 3 AM to head to the office early to provide an update to clients and hopefully allay some fears. Most pundits predicted that a Trump victory would cause a market recession and stocks would tank. For the most part, the markets predicted a Clinton victory and that win would be considered a good thing.

Clinton was the known entity, the comfortable choice. What the markets dislike is uncertainty. This was exactly what the dark-horse, Trump, was. By 7 AM, however, things started to look different. The fear of the unknown slowly dissipated. The futures started to move upward.

By the end of the day, markets were positive. It was certainly an unexpected reversal with over a 1,000-point swing. I couldn’t fathom how something that was supposed to be so bad for the markets turned around in a matter of hours. There was a lot of speculation about why, but nobody truly knows for sure.

2020 Election & the Stock Market

2020 will also be a unique, interesting election year. While many attempted to predict what a Trump or Biden win may mean for the markets, the truth is that no one can predict the future.

Giving in to political fears or expectations by making changes to your investment portfolio can be perilous. The story above regarding the 2016 election serves as a fitting example of how predictions can go awry. The markets can incorporate and adjust to new information.

Historically, the stock market can be volatile in the months leading up to an election. As mentioned earlier, the markets dislike uncertainty. It makes sense that the markets would be volatile when election results are unknown.

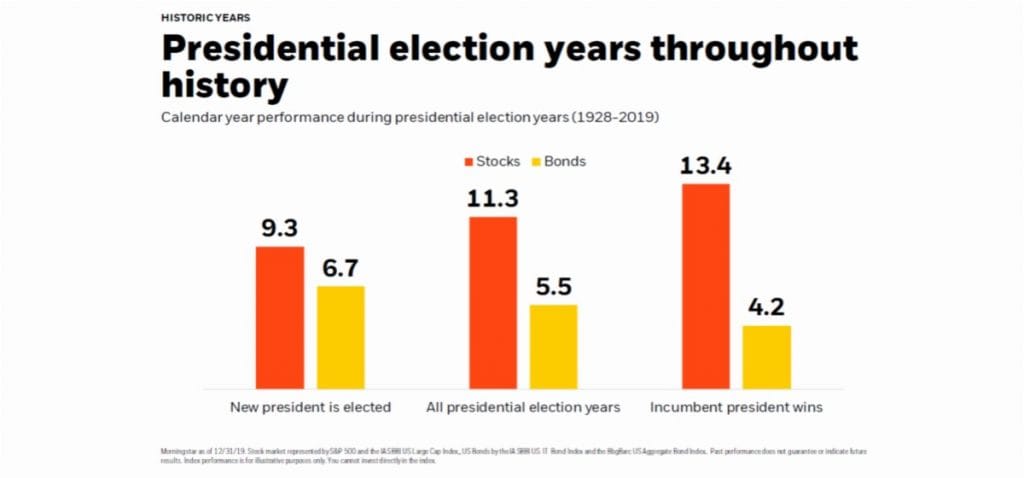

We have also seen that market performance is better in years when an incumbent president is reelected. Economists believe this is the case because reelection avoids the uncertainty around a new administration and the policy changes that may ensue.

Source: Black Rock

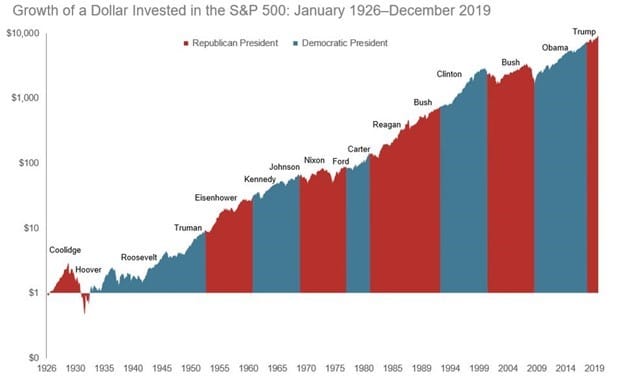

Looking Back

Let’s take a look at another historical trend, per a 2019 Dimensional Funds report. We have only seen negative returns in 4 of the last 23 presidential election years. To illustrate, the following chart shows the market results for the S&P 500 for the last 6 presidential election years.

Looking Forward

If we had to guess, investors likely think more about how the election impacts the markets. Still, history shows that the markets may more reliably influence the election. Specifically, stock market performance leading up to an election has been a major indicator of the outcome.

In years where the S&P 500 has risen in the three months before Election Day, the incumbent party went on to win the election 87% of the time since 1928 and 100% since 1984. The truth is, we don’t know who will win the election. We also don’t know exactly how the markets will react.

History can show us some patterns between past elections and market performance. Past performance is no guarantee of future results. What we do know is that whoever wins will not affect our overall investment approach or portfolio allocations. We continue to own and hold the best breed companies alongside you. We hope you trust us and do the same.