Recession? You Bet! Keep Reading…

Will we have a recession?

Is it coming? The answers to those questions are, “yes.” However, please keep reading. What nobody truly knows is when a recession will actually take place. Economists use charts, data, surveys-all of which are great but provide no clear indication of a recession.

I’ve been hearing that a “recession” has been coming for the last three years. In that time, the S&P is up a paltry 45+%. Perhaps we are talking ourselves into a recession. Three years is a long time to be “talking.”

Over the last few weeks, volatility and political mudslinging intensified. This certainly doesn’t make anyone feel good. Between China, Syria, and impeachment, there is undoubtedly cause for concern.

Clients would like to believe we have a crystal ball and can move in and out of the markets avoiding collapses and capitalizing on upswings. We aren’t soothsayers. I believe market timing is a fool’s game.

In fact, research firm Dalbar looked at investor returns relative to the markets. What they found wasn’t surprising. Investors in equity funds have actually lagged the S&P 500 by an average of almost 5%.

Why?

They believe that a primary driver to this outcome is poor timing or “buying high and selling low.” You may get lucky once, maybe even twice, but the odds are certainly stacked against you.

Don’t miss the good days!

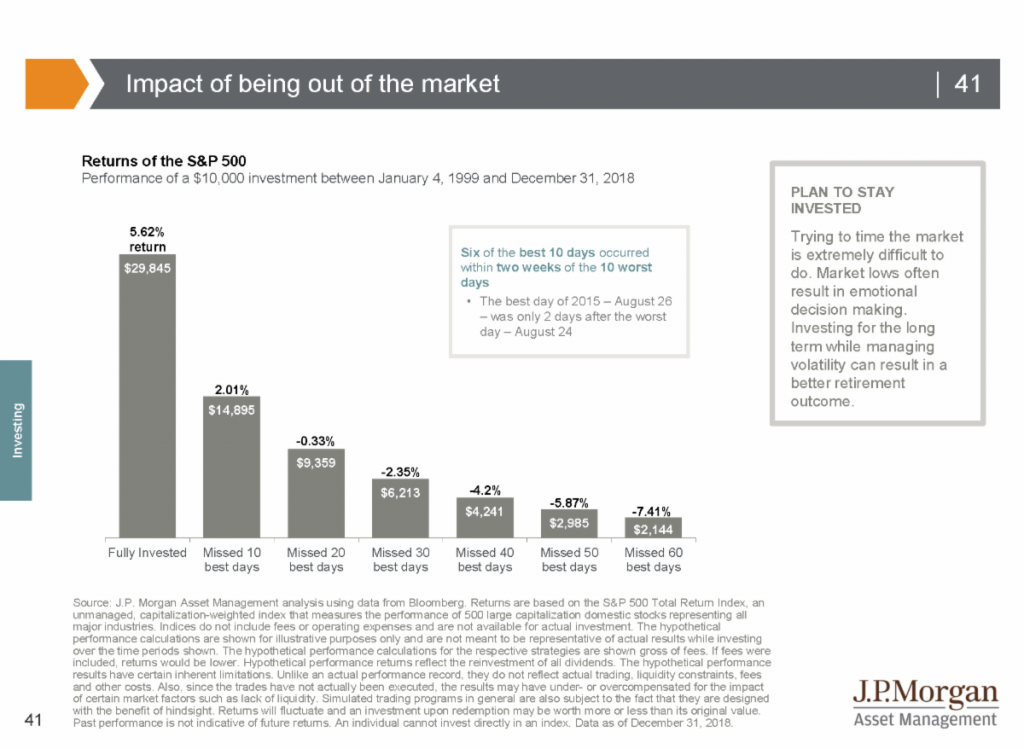

Additionally, we mentioned this before, missing out on the best days in the market can drastically impact your returns. I don’t mean it in a good way.

J.P. Morgan calculated that if you missed out on the best 10 days of the markets from January 1, 1999, to December 31, 2018, your overall return was cut in half.

Many clients heard me tell the story about my experience on election night in 2016. In pre-market before the markets open and an indication of how they will open, the Dow Jones was down over 900 points. I prepared myself for a bloodbath. I was ready to write to you like I’m doing now.

As the day unfolded, the entire financial community, myself included, watched as the markets once again did the unexpected. By the end of the day, the Dow was up 72 points, almost a 1,000-point swing. Moves like this are not for the faint of heart.

Looking back now, that huge move was simply a blip on the radar. Right now, we are not recommending any major changes to our portfolios. The bottom line here is we don’t know when the next recession is going to take place. Nobody does.

What we do know is that if history is any indication, our eyes will see Dow rise to 100,000. Will there be recessions until we reach that point? Absolutely. Should it impact our day-to-day investments? Absolutely not.