How are Roth & Traditional IRAs different?

Coke vs. Pepsi, Mayonnaise vs. Miracle Whip, Twizzlers vs. Red Vines, some conversations go on until the end of time. However, the first item listed in each pair is clearly the superior option. A major investment discussion is undoubtedly tax-free vs. tax-deferred retirement accounts.

Though both are examples of tax-advantaged accounts, tax-free (Roth) and tax-deferred (Traditional) accounts are different. In fact, if you have some extra money to invest, you also have a third option, a taxable account.

This article helps you navigate which accounts are best for you, a tax-free account, like a Roth IRA or Roth 401k, a tax-deferred account, or a Traditional IRA or Traditional 401k, a taxable account.

First of all, why are there so many accounts?

Why couldn’t there be one account? If there were only one account type, it would undoubtedly be the taxable account. That way, the government could get paid anytime you made money investing.

The abundance of account types is actually a good thing. The government created these other account types to try to encourage saving for retirement. These extra account types exist to help you save and invest in a tax-advantaged way.

Can I put any investment in any account?

Yes, you can. Generally speaking. However, you won’t be able to put all of your investments in tax-advantaged accounts. Though you would want to, unfortunately, there are annual contribution limits.

You need to split your investments between taxable and tax-advantaged accounts. One perk of tax-advantaged accounts is that investments grow tax-free. Rebalancing investments, which could cause a capital gain in a taxable account, are tax-free, as are dividends and interest.

How are Roth & Traditional IRAs different?

Contributions to Roth IRAs are with after-tax dollars, dollars in your bank account, for example. Then, they grow tax-free inside the Roth. When you take the money out after age 59 ½, you don’t pay any taxes.

Typically, for Traditional IRAs, you contribute with pre-tax dollars. Dollars in your bank account are after-tax. When you contribute to a Traditional IRA, you can deduct those dollars from your taxes.

This effectively turns them back into pre-tax dollars that grow tax-deferred inside the Traditional IRA. When you take the money out after age 59 ½, you pay ordinary income tax on everything taken out. This is the first major difference.

For Roth, you pay taxes upfront. For Traditional, you pay taxes later when you withdraw funds. If you think your tax rates are lower now than they could be in the future, a Roth may make more sense. If you think taxes could fall in the future, a Traditional may make more sense.

Many find Roth’s more appealing because they remove the unknown risk of future tax rates and because some economists believe the large U.S. deficit requires future income taxes to be higher. Many calculators help determine which could be better for you.

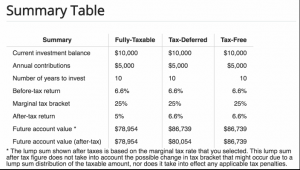

If you start with $10k and invest another $5k a year for 10 years, using the assumptions below, you would end up with $78,954 in a taxable account, $80,054 from a Traditional (tax-deferred) account after withdrawal, and $86,739 in a Roth (tax-free) account. We must remember that you can deduct the Traditional investment each year from your taxes.

This is a partial tax benefit in each of the prior 10 years for the Traditional.

There are some similarities between Roth & Traditional IRAs.

You cannot contribute more than you earned in a year for either Roth or Traditional. You cannot exceed IRS limits. For 2019, it’s $6k if under 50 and $7k if 50 or older.

The deadline is April 15th of the following year to contribute. Maine and Massachusetts residents have until April 17, 2019. You can withdraw funds after age 59 ½ without penalty.

What are other benefits of a Roth?

You can contribute to a Roth at any age. You must be under age 70 ½ for a Traditional. If you need money from your Roth before age 59 ½, you can take out your original contribution amounts at no penalty.

Taking out earnings from a Roth early has a 10% penalty. Taking out anything from a Traditional early has a 10% penalty, plus tax. There are no required minimum distributions (RMDs) from Roth IRAs while you are alive. For Traditionals, RMDs start at age 70 ½.

Are there any other perks of Traditional IRAs?

There are income limits (Modified Adjusted Gross Income) to contribute to a Roth that do not exist for a Traditional. However, you may side-step these with a back-door Roth. You can deduct some or all of your contribution to a Traditional IRA, though there are limits you must meet to deduct.

You can take earnings tax-free from a Roth after age 59 ½, and the Roth is at least 5 years old. There is no minimum age for a Traditional. If you have any questions about Roth or Traditional IRAs, please let us know. As always, keep calm and invest on.